Fund Accounting Manager

Fidelity

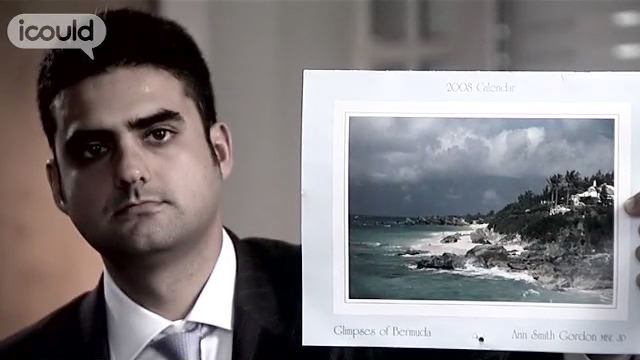

Magna A

00:00:03 My name is Magna A, and I’m a Manager in the Fund Accounting area of investment administration. Investment administration is the back office of Fidelity Investments in London, and we carry out what we call the operational work. So we do all the back office work, in essence that means settling trades, reconciling the cash positions, corporate actions, we price our products, Fidelity is an investment house and we have various products, we have OEICs, unit trusts, investment trusts, and all these funds have to be priced on a daily basis. And we also are required to prepare, to help prepare rather, Annual Reports and Accounts, and that’s what I’m involved in.

00:00:51 I was raised in Zimbabwe, and I emigrated to England six years ago, when the political crisis in Zimbabwe started to get worse. And really just came in search of better opportunities, and I think London is a fantastic city. I can still remember the day I went for my interview, arriving at Bank station, and there was the Bank of England, and I think architecturally that’s such a solid building, and to me that represented everything about this country. You know, solid, financially strong, the ethics were there and it was nothing like where I was coming from, so it was great.

00:02:10 In Zimbabwe we had O levels, and funnily enough we – I sat for the Associate Examining Board, which is actually an English Examining Board. So very much like England – in England, rather. We did our O levels, and out of O levels you then had to choose three subjects that you wanted to do at A level. And I chose French, Maths and Biology. Unfortunately I was denied the opportunity of going to University, my parents could not afford to send me to University. So as soon as I left school I went to work for the Tax Office, and that’s really where I was introduced to Accountancy, because they did pay for me to do my studies. And I think even if you can’t go to University, the important thing if you do want to learn, if you do want to study, is that there are other options out there, you don’t necessarily always have to go to University. There are colleges, and most companies as well will be able to offer you some choice of formal education. We here as well encourage our youngsters, even after they’ve left University, to go on to pursue accounting studies.

00:02:43 When I got to England to look for work, it was in 2002 and it was – markets weren’t – weren’t going anywhere really, so it wasn’t easy to find work. That said, it wasn’t impossible, and I started out by doing temp work. And then after that I left to go to a company called Cogent Investment Administration. And I was very lucky to get that position. I think the person who interviewed me read my CV, realised I had a strong financial accounting background. But I suppose I have struggled in that I had – I’ve come to a foreign country, to England, I’ve had to re-establish my career. So I suppose you could say that where I am now, as opposed to where I was going all along, I’ve had to make a few adjustments, and I’ve had to adapt and cope with different working environment. But I think one thing I’ve learnt is that it’s OK occasionally to get it wrong. ‘Cause if you don’t – if you always get it right, then chances are you’re probably not challenging yourself enough. So if there’s one thing I’ve learnt I suppose, it’s to learn to accept mistakes I make, and be a bit more tolerant towards other people.

ENDS

Magna A is a Manager in the Fund Accounting at Fidelity. She works in what is called the “back office” – the bit that does the operational work – sorting everything out. She did not go to university – but studied accountancy – which was paid by her employers.

More information about Financial accounts managers

The UK average salary is £29,813

There are 37.5 hours in the average working week

The UK workforce is 47% female and 53% male

Future employment

- Develops and manages business accounts to increase sales of financial products

- Takes responsibility for the efficient and effective operation of several business accounts

- Manages teams handling insurance claims

- Checks customers’ credit rating with banks and credit reference agencies, and decides whether to offer credit

- Establishes terms of credit and ensures timely payment by customer, renegotiates payment terms and initiates legal action to recover debts if necessary

- Carries out and/or supervises general accounting and administrative work